Models perhaps not acquired punctual can be denied an exclusion or prevention. Industrial a property characteristics usually order large local rental rates, resulted in high productivity. This type of characteristics tend to element high limit costs and you will production than simply qualities. Domestic a house provides among the better income tax pros and you may usage of influence. You might write down certain expenditures as a result of decline and rehearse an excellent 1031 replace to delayed financing development taxes on the a not too long ago sold possessions. REITs can afford investors entryway for the nonresidential investment including malls or workplace structures, which can be basically maybe not feasible for private investors to shop for in person.

An identical laws to possess stating a card to own withholding of tax below https://vogueplay.com/tz/tonybet-casino-review/ area 1445 apply at transferors choosing Setting 8288-A saying borrowing from the bank for withholding less than area 1446(f)(1). The rules per Models 8288 and you can 8288-A provided within part try described, after, less than U.S. Real estate Desire, Revealing and Paying the Taxation as well as in the newest Tips to own Form 8288.

International Intermediaries

An elementary investment group rent is within the individual’s label, and all the brand new equipment pool area of the book to fund openings. It indicates you’re going to get particular income even if the tool is actually empty. For as long as the brand new vacancy price for the pooled products doesn’t increase way too high, there must be enough to defense can cost you.

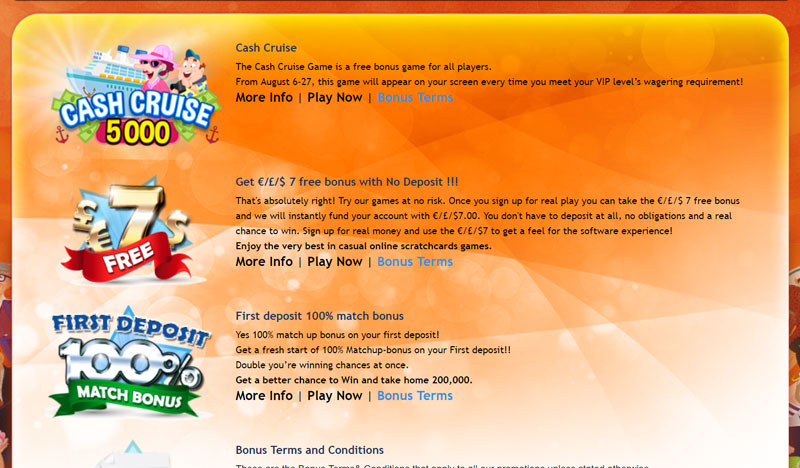

Enjoy On line Resident Casino Online game

As well, areas with lowest vacancy costs, lingering infrastructure development, and you can property manager-friendly regulations usually are appealing to investors. Typically, you should withhold on the spend (wages) to have founded private characteristics having fun with graduated rates. The fresh nonresident alien must complete Form W-cuatro, because the mentioned before lower than Unique guidelines to possess Function W-4, and you also have to statement earnings and income tax withheld on the Function W-dos.

A qualified grant form one amount paid off so you can an individual while the a scholarship otherwise fellowship give on the the total amount you to, according to the requirements of your offer, the amount is usually to be useful for next costs. If you do not understand the number of the fresh obtain, you must withhold an expense must make sure the income tax withheld will not be less than 31% of your own recognized obtain. The total amount getting withheld, although not, must not be over 30% of one’s matter payable by deal. You need to keep back during the 30%, or if relevant, a lower pact speed, for the terrible number of next items.

As with any investment, there’s cash and you can chance which have a property investing and you will segments can go up as well as the down. The best home crowdfunding networks pool types of buyers appearing to possess options with other investors searching for economic support for real house projects. Providing you with the fresh investor an opportunity for diversifying to your home instead setting up a huge risk. When examining REITs, buyers will be identify ranging from security REITs you to definitely very own structures and mortgage REITs that give money the real deal property that will dedicate within the financial-backed bonds (MBS). Furthermore, some (even if not all the) REITs is extremely h2o because they’re exchange-traded trusts. In practice, REITs try a formalized sort of a real estate investment class.

The location and you may fiscal conditions impact all kinds of a house. However, financial improvements has a healthier impact on industrial home. Organization schedules feeling for every occupant’s ability to afford commercial space and get in business.

If you do not features cause to believe otherwise, you can even have confidence in the fresh authored report of the individual entitled for the income from what quantity of acquire. The design W-8 or documentary proof must inform you the new helpful user’s base in the the home giving go up on the get. An excess introduction allocated to another overseas people need to be found in one to individuals money meanwhile since the almost every other money from the entity is roofed inside earnings. A domestic relationship need to independently state an excellent lover’s allocable display from REMIC nonexempt money otherwise net losings as well as the an excessive amount of introduction count to the Schedule K-step 1 (Setting 1065). If your partnership allocates all or certain part of the allocable share from REMIC nonexempt earnings to a different companion, the brand new mate must range from the partner’s allocated amount in the money while the if that amount are gotten to the earlier of one’s following the times. But when it comes to interest paid back to the an obligation away from the us, attention repaid so you can a financial to the an expansion out of borrowing made pursuant to help you that loan arrangement inserted to the regarding the typical course of one’s bank’s exchange otherwise business doesn’t meet the requirements because the profile focus.